The Turtle Trading Strategy: The Complete Guide for Modern Traders

The Turtle Trading Strategy is one of the most legendary systems in financial history. It is a system built not on secrets or insider knowledge, but on structure, discipline, and rules that can be repeated by anyone with the patience to follow them. The story behind it is as famous as the strategy itself. Richard Dennis, a commodities trader who turned a small stake into hundreds of millions, believed great traders were made, not born. His partner, William Eckhardt, disagreed. To settle the argument, Dennis took a group of everyday people, trained them for only two weeks, and sent them into the markets with real money. They became known as the Turtles. Many went on to become multimillion-dollar traders.

What made the Turtle Strategy so powerful was its simplicity. It did not require predictions, forecasting, chart patterns, or gut feelings. It required rules. Clear rules. Followed the same way every time. In a world where most traders chase signals and switch strategies constantly, the Turtle method represented the opposite approach. It embraced long-term thinking, trends over noise, patience over impulse, and data over emotion. This is why the Turtle Strategy is still studied today, even though markets have evolved.

At its core, the Turtle Strategy is a trend-following system. It teaches traders to buy strength, sell weakness, and ride momentum until it ends. It does not try to pick tops or bottoms. It respects price movement as the ultimate truth. The strategy waits for breakouts from long-term ranges, enters positions with fixed rules, and cuts losses aggressively when price reverses against the trend. It then manages winners with equally strict rules, allowing big trends to compound gains over time.

The philosophy behind the Turtle approach is simple. Trends exist because markets reflect crowd behavior, not efficient calculations. When fear or greed builds, prices move with strength, and they continue moving until something breaks the rhythm. The Turtle Strategy tries to capture the middle of that move. Not the beginning. Not the end. Just the most profitable part.

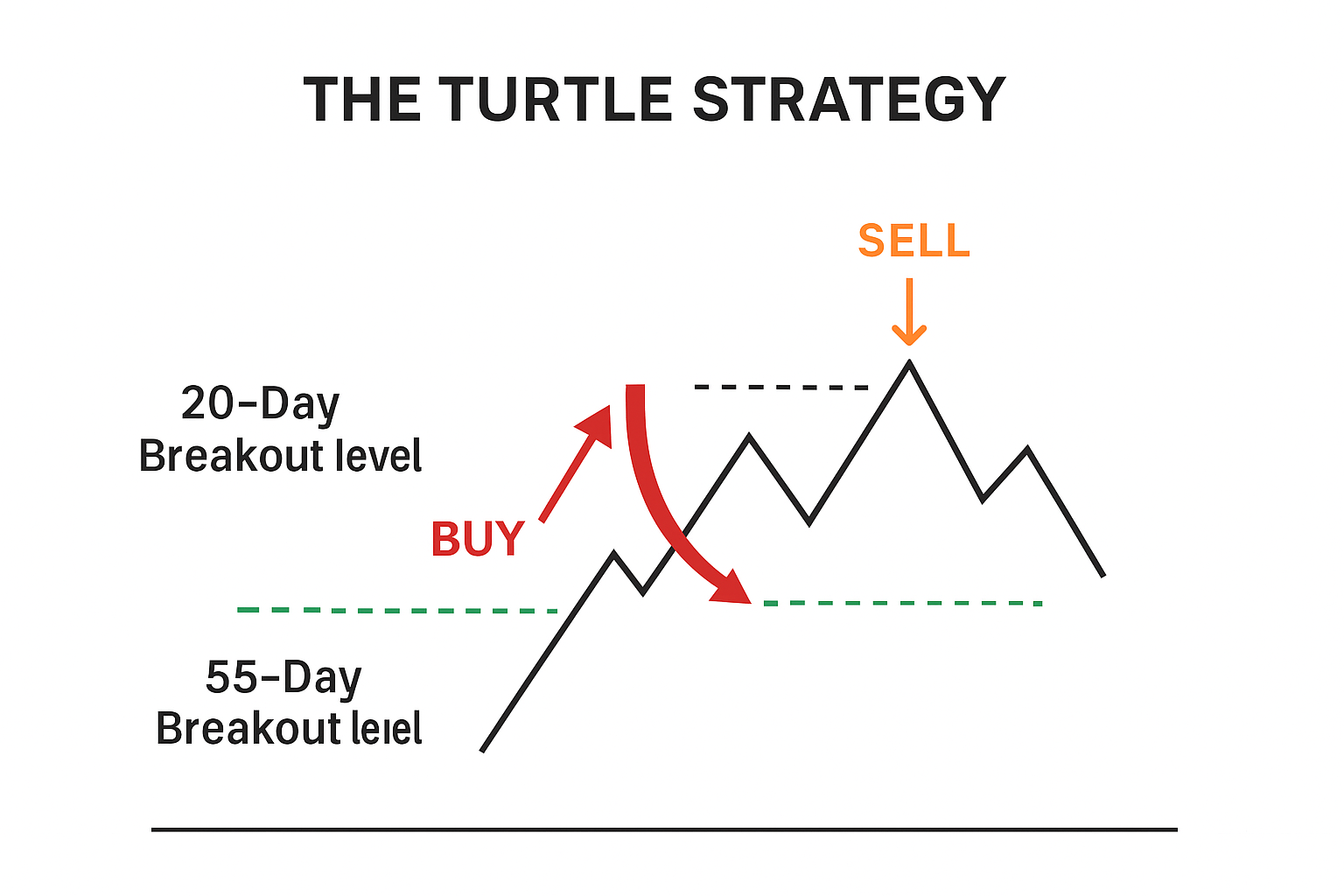

To understand the heart of the Turtle Strategy, you need to understand the breakout systems it used. The Turtles relied on two breakout channels based on market volatility. The shorter breakout system used a 20-day high or low. If price broke above the 20-day high, the system entered long. If it broke below the 20-day low, the system entered short. The longer breakout system used a 55-day high or low. These breakouts were signals that price was leaving its comfort zone and beginning a possible trend.

The Turtles did not chase every breakout. They used filters. For example, the 20-day breakout signal was ignored if the last breakout in the same direction was a winner. The logic was simple. If a recent breakout already produced a profitable trend, entering another one immediately might be redundant. But the 55-day breakout was always taken, because stronger moves can begin even after recent trends.

One of the most important components of the Turtle Strategy is the position sizing method. This is the part that many traders misunderstand. The Turtles were not looking to be right more often than wrong. They were trying to stay alive long enough to catch the rare, powerful trends that would shape their entire year. To do this, they used a model based on volatility called N. It measured the average true range of a market and adjusted position size accordingly. When volatility increased, positions became smaller. When volatility decreased, positions became larger. This kept risk consistent across different market conditions.

Each position was built using units. A unit was the amount of a position that risked one percent of the account. The Turtles added units as the trend moved in their favor but only when price moved enough to justify increasing exposure. This is known as pyramiding. It allowed them to ride strong trends with size while keeping risk-controlled in choppy markets.

Just as important as entry and position size were the exit rules. The Turtles exited losing trades quickly. They used stop losses based on multiples of volatility. If price moved against them by a certain amount, they closed the trade without hesitation. This was non-negotiable. The system did not allow exceptions. Losers were kept small every time. As a result, a typical Turtle trader experienced many small losses and a few big wins. Those big wins paid for everything else.

Risk management was the backbone of the method. The Turtles had strict rules for maximum exposure across correlated markets. They also had rules for how much of their total portfolio could be at risk at once. These rules ensured they would not blow up from one bad market cycle. The system was built to survive almost anything.

One of the biggest misconceptions about the Turtle Strategy is that it works only in commodities or slow-moving futures markets. In reality, the principles of trend following apply across all asset classes. Whether you trade stocks, crypto, forex, options, or futures, the behavior of crowds does not change. Trend-following strategies still work because human emotion still drives price action.

In the modern market, traders use Turtle principles but adapt them for digital platforms, faster data, and more diversified portfolios. For example, instead of using 20-day and 55-day breakouts, some traders use moving averages, Donchian channels, or volatility-adjusted breakout structures. Algorithmic versions of the strategy automate entries and exits and control risk with precision. But the foundation still comes from the original Turtle rules.

The most important lesson from the Turtle Strategy is the value of unwavering discipline. The greatest weakness of most traders is inconsistency. They change their method after a few losses. They override rules. They skip trades. They chase signals that do not fit their plan. The Turtles proved that consistency can outperform intelligence. They showed that a trader with a mechanical system and the courage to follow it can outperform sophisticated analysts who rely on predictions.

Another key lesson is emotional resilience. The Turtle Strategy creates long periods of small losses and flat performance. This is the part most traders cannot handle. They want instant gratification. They want action. But trend-following requires patience. Trends do not form every day. The system demands trust in the process, even when results are slow.

The psychology of the Turtle Strategy is powerful. It teaches traders to detach from the outcome of individual trades. Every trade is just one event in a long series. What matters is the law of large numbers. If you follow the rules, the rare big trends will eventually show up. When they do, the system makes enough to cover months of small losses.

Many of today’s best-known traders reference Turtle principles. Trading educators on YouTube such as Option Alpha, Sky View Trading, Rayner Teo, and The Trading Channel often mention trend-following concepts similar to what the Turtles used. Professional traders in hedge funds and systematic trend-following firms still rely on variations of this method.

The Turtle Strategy also aligns well with modern data-driven trading. Backtesting tools, volatility indicators, and position-sizing models give traders clarity that was not available decades ago. But even with improved technology, the challenge remains the same. Traders must follow rules without letting emotion interfere.

The biggest question traders ask is whether the Turtle Strategy still works today. The honest answer is yes, but not in the exact same form. Markets move faster now. Liquidity is higher. Algorithms create noise. Correlations change quickly. But breakout-based trend-following strategies still capture major moves because large trends still occur. The Turtle principles work because they are not tied to specific market conditions. They are based on human behavior and market structure.

If you want to apply the Turtle Strategy today, you need to make a few adjustments. You must account for faster markets. You must adapt the breakout lengths you use. You must update risk controls to match volatility cycles. But the core idea remains solid. Trade in the direction of strength. Cut losses quickly. Let winners grow. Use volatility to size positions. Stay consistent across every trade.

The modern Turtle trader uses charting tools like ATR, Donchian channels, or volatility bands to define entries and stops. They follow multiple time frames but stay loyal to the system. They avoid predicting and trust price behavior. They recognize that the market rewards discipline more than cleverness.

This strategy teaches traders one of the most valuable truths. You do not need to predict the future. You only need to react to the present with a plan. The Turtles did not guess where markets were headed. They waited for price to show direction. Then they followed that direction until it ended.

This method is timeless because trends are timeless. Whether it is the rise of a tech stock, the drop of a currency, or the breakout of a cryptocurrency, trends create opportunity. The Turtle Strategy gives traders a way to participate without guesswork.

More importantly, it gives traders structure. A trader without structure is vulnerable to every impulse. But a trader with structure can operate with confidence. The market becomes a system of probabilities, not chaos.

The Turtle Strategy is not easy. It is simple, but simple is not the same as easy. It requires emotional maturity, patience, and the strength to follow rules during difficult periods. That is why the original Turtles succeeded. They were chosen not for talent, but for their willingness to follow rules.

If you want to become a modern Turtle, start by building a system you trust. Define your entries, exits, stops, and position-sizing rules. Test your system. Then trade it with commitment. Ignore the noise. Follow your signals. Review your trades without judgment. Over time, you will develop your own version of the Turtle mindset.

The strongest traders in the world are not the most intelligent. They are the most disciplined. This is the legacy of the Turtle Strategy. A reminder that rules, structure, and patience can outperform prediction and complexity.

If you embrace those principles, you are already ahead of most traders.