Mark Minervini: The Complete Guide to the SEPA Master and His Trading Philosophy (2025 Edition)

If you spend any meaningful time studying stock trading, sooner or later you encounter the name Mark Minervini. He is one of those rare traders who not only achieved extraordinary returns in the market but also openly shared his entire trading approach with the world. Known for his mastery of growth stock trading and his iconic SEPA method, Minervini stands as a symbol of discipline, precision, and structured execution. In an era where noise and speculation dominate the trading world, his methodology remains a beacon of clarity for new and experienced traders alike.

Mark Minervini began as an everyday trader in the 1980s, struggling through repeated failures, emotional swings, and inconsistent performances. His early years were filled with frustration, as he lacked mentorship, tools, and structure. He was completely self-taught, spending countless hours studying charts, analyzing earnings data, and experimenting with strategies that often didn’t work. But over the years, through relentless trial and error, he discovered a powerful blend of technical analysis, fundamentals, timing, and strict risk management. This eventually evolved into his celebrated SEPA framework—Specific Entry Point Analysis—a systematic method designed to identify explosive stocks right before they make their biggest moves.

Minervini’s trading results speak for themselves. He became the U.S. Investing Champion in 2021 with a phenomenal audited return of 334.8%. Beyond trophies and titles, he has maintained over three decades of consistent profitability—a track record very few traders in history can claim. His books, including Trade Like a Stock Market Wizard, Think and Trade Like a Champion, and Mindset Secrets for Winning, are regarded as essential reading for growth stock traders and are frequently referenced by elite professionals as well as everyday retail investors.

Understanding the SEPA Method

At the heart of Minervini’s success lies the SEPA technique, which he developed after years of observing how the biggest winning stocks behaved before their major price advances. SEPA is not merely a chart pattern or a breakout strategy—it is a full ecosystem of trend analysis, fundamental strength, chart structure, entry precision, and uncompromising risk control.

The first pillar of SEPA is the emphasis on trading only in the direction of strength. Minervini is very clear about avoiding downtrending stocks. He insists that the strongest price movements come from stocks already showing leadership, stocks whose price and relative strength are already signaling institutional accumulation. In his system, a stock must be trending above key long-term moving averages and should be outperforming the broader market and its sector peers. Weakness, in Minervini’s view, is an immediate disqualifier. He does not entertain bottom-fishing or speculative guessing.

Yet trend alone is not enough. Minervini places great importance on fundamentals, specifically earnings and sales growth. He studied market history extensively and found that almost every major stock market winner—whether it was Microsoft, Apple, Tesla, or Nvidia—showed explosive earnings growth before their massive runway periods. For him, strong fundamentals provide the underlying justification for price strength. He tends to focus on companies delivering 20–30% or higher earnings and revenue growth, strong margins, new product cycles, or other catalysts that justify institutional buying. In SEPA, the marriage of strong fundamentals with strong price action is non-negotiable.

The Power of Chart Structure

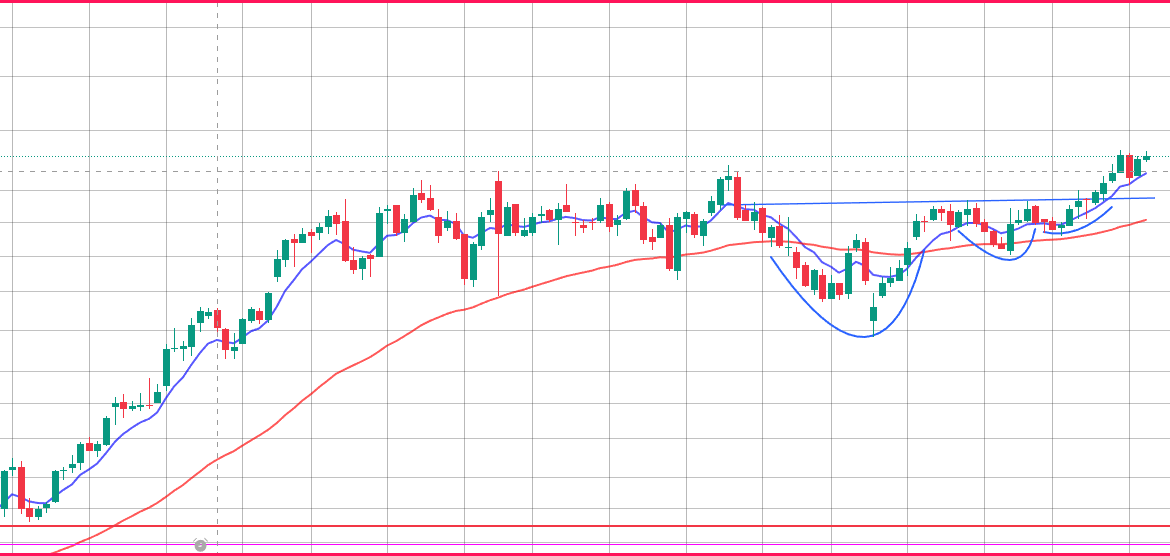

One of the most distinctive aspects of Minervini’s system is his focus on the quality of chart patterns rather than their shape alone. While many traders look for basic formations like cup-and-handle or double bottoms, Minervini looks deeper into how volatility behaves within those structures. One of his key innovations is the identification of the Volatility Contraction Pattern (VCP).

The VCP describes a situation where a stock goes through a series of pullbacks, and each pullback becomes successively smaller. This contraction in volatility signals that supply is drying up, sellers are losing interest, and buyers are gradually gaining control. When the price tightens significantly and volume becomes low and quiet, the stock essentially becomes “coiled” like a spring. This is often the precursor to a powerful breakout. The VCP is so central to Minervini’s trading that many traders now consider it one of the most reliable setups in modern growth stock trading.

Another pattern Minervini values highly is the tight weekly close. When a stock closes within a small price range over several weeks, it often indicates that institutional buyers are supporting the stock at those levels. This creates a low-risk environment where a breakout above recent highs becomes more predictable. Minervini frequently mentions that the best trades he ever entered showed clear signs of contraction and tightness before the breakout—evidence of professional accumulation and reduced supply.

Specific Entry Point: The SEPA Breakout

Minervini’s true brilliance lies in identifying the exact moment when probability and risk converge at the most favorable point. This is what he calls the Specific Entry Point. Unlike traditional breakout traders who buy any move above resistance, Minervini is extremely selective. He waits for a stock to form a clean pivot point, usually at the top of a tight consolidation or VCP structure.

He wants the breakout to occur with explosive volume and ideally with strong relative strength signaling that the stock is outperforming the market on that day. This approach allows him to enter at the precise moment when buyers decisively overwhelm sellers. He describes this as “buying at the moment of least risk,” because the consolidation’s tightness ensures that if the trade fails, the stop-loss can be placed extremely close to the entry.

This is one of the reasons his system allows him to control risk better than many other strategies. A tight consolidation with a clean pivot lets him cut losses quickly, often at just 3–5%, keeping damage small while letting winners expand into large gains.

The Minervini Approach to Risk Management

Even though Minervini is known for identifying powerful winning stocks, his philosophy is rooted in protecting capital first. He frequently states that the secret to long-term success is not losing when others are losing.

He is strict about cutting losses quickly. In his books and interviews, he talks about never allowing a losing position to fall more than 7–10% below his purchase price, and often much less if the pattern indicates a tighter stop. He refuses to average down under any circumstances because he believes that adding to a losing trade is one of the fastest paths to financial ruin.

When he adds to a position, it is only when the stock is moving in his favor—a method known as pyramiding. The idea is simple: increase size only when the market proves you right. This disciplined approach allows him to stay aggressive during strong bull markets while staying completely defensive during market weakness. For Minervini, holding cash is a valid position during unfavorable market phases. He steps aside without hesitation, waits patiently, and attacks only when conditions align with his strategy.

Mindset and Psychology

Beyond charts and fundamentals, Minervini places enormous emphasis on psychology. He openly admits that many of his biggest failures early in his career were emotional, not analytical. His writings often focus on discipline, patience, self-awareness, and mental resilience.

He teaches traders to avoid emotional impulses, to stop trying to force trades, and to recognize when confidence is affecting risk-taking behavior. One of his core beliefs is that confidence should come from preparation, not from random wins. He spends hours analyzing hundreds of charts each week to maintain clarity, understanding, and familiarity with market structure.

This level of preparation allows him to act decisively during market opportunities and remain calm during drawdowns. It also explains why SEPA is not simply a mechanical system—it’s a disciplined lifestyle approach to trading.

Why Minervini’s Methods Still Work in 2025

While markets have evolved significantly over the past four decades, the core drivers of price remain the same. Human behavior continues to generate patterns, institutional accumulation still drives big moves, and earnings growth remains the central fuel behind the strongest stocks. These foundational elements ensure that the SEPA method remains effective in the modern trading environment.

Even in 2025, as algorithmic trading becomes more prevalent and global markets are more interconnected than ever, Minervini’s emphasis on tight consolidations, strong fundamentals, and favorable market context continues to produce exceptional results. His strategy has survived multiple economic cycles, technological revolutions, and market crashes. The reason is simple: SEPA is built on timeless market principles rather than temporary market conditions.

How Beginners Can Apply Minervini’s Concepts

For new traders looking to build a solid foundation, Minervini’s framework provides a highly structured roadmap. The first step is understanding basic price and volume behavior, learning to read chart patterns, and becoming familiar with market cycles. Reading Minervini’s first book is a natural starting point, as it breaks down SEPA into digestible concepts supported by real-world examples.

The next phase involves studying charts that display VCP patterns and tight bases. The more examples a trader studies, the sharper their pattern recognition becomes. Paper trading or simulated trading with Minervini-style setups can help build confidence before real capital is deployed. Above all, he recommends meticulous record-keeping. Every trade should be journaled, analyzed, and reviewed. This continuous self-feedback loop is central to mastering SEPA.

A Realistic Outlook

It is important to understand that Minervini’s legendary returns are rare even among elite traders. Most traders should not expect 300%+ annual gains. His system is powerful, but it requires high levels of discipline, patience, and emotional control—qualities that take time to develop. A more realistic outcome for a disciplined trader following Minervini’s approach is steady annual growth with minimal drawdowns. Over years, such consistency leads to compounding that can be life-changing.

Final Thoughts

Mark Minervini is not just a trader; he represents a complete philosophy of trading rooted in discipline, precision, and continuous improvement. His SEPA method integrates trend analysis, fundamental strength, chart structure, entry timing, and risk management into a seamless framework that continues to deliver results decades after he first developed it.

For anyone serious about improving their trading in 2025 and beyond, studying Minervini’s work is not optional—it is essential. His focus on tight consolidations, volatility contraction, strong fundamentals, and disciplined execution provides a roadmap for navigating modern markets with clarity and confidence. Whether you’re a beginner or an experienced trader, there is always something powerful to learn from the man who mastered the art of catching explosive stocks at the perfect time.